If you’re looking to escape the cycle of living paycheck to paycheck, learning the basics of budgeting, saving, and investing is what makes financial education for beginners so important for building a strong and steady future.

Building smart money habits now can lead to financial security, less stress, and a brighter future for you and your family.

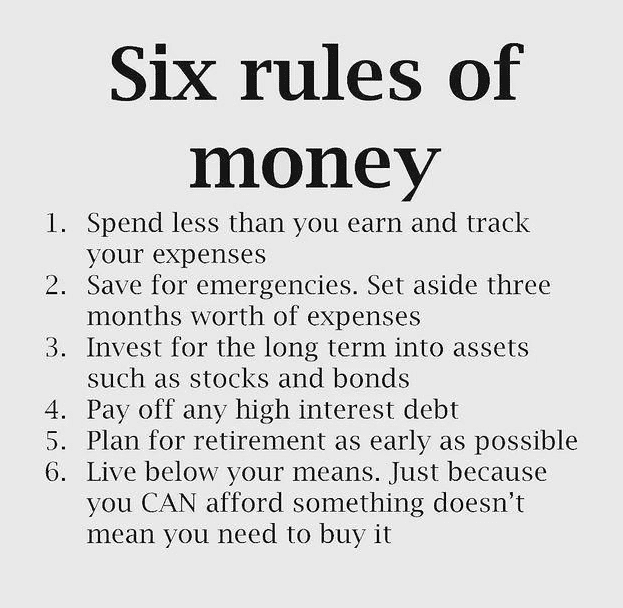

Here are 6 essential habits packed with financial advice for young people to help you avoid common money mistakes and work toward a stable financial future.

Why Financial Education for Beginners is so Crucial

A lot of people struggle with money because they haven’t learned the simple habits needed to stay financially stable. A recent survey found that only 24% of millennials understand basic money skills.

This means many people don’t know how to budget, save, or invest wisely. For young people and people just starting out, learning these important skills from financial advice websites is a big step towards gaining control of your finances.

So when I talk about smart money habits, I’m referring to learning the basics. That’s where we need to begin! As I just mentioned, only 24% of young people (specifically single mothers and engaged couples) actually KNOW the proper way to handle money. Without this knowledge, it’s easy to make mistakes like spending too much or not saving for what’s ahead.

Topic | Details | Takeaway |

Financial Literacy Stats | Only 24% of millennials demonstrate solid financial literacy. | Most people lack basic money management skills. |

Common Struggles | Many don’t know how to budget, save, or invest. | Leads to living paycheck to paycheck and financial stress. |

Importance of Education | Financial education for beginners builds a foundation for managing money wisely. | Learning these skills is the first step toward financial freedom. |

Bad Habits | Overspending, failing to save, and not preparing for the future. | These habits create financial instability and missed opportunities. |

Good Habits | Budgeting, saving, and investing. | Making smart daily choices helps achieve long-term financial independence. |

Expert Advice | Dave Ramsey says: “You must gain control over your money, or the lack of it will forever control you.” | Gaining control of your money reduces stress and unlocks life opportunities. |

Why It Matters | Being financially stable isn’t about getting rich quick. | It’s about creating small, consistent habits that lead to a secure and fulfilling future. |

The majority of people live paycheck to paycheck, stressed about bills and unexpected expenses. But with the right habits, anyone can take control of their money and start working toward financial independence.

Being financially stable isn’t about getting rich quick. However, it is about making smart choices with your money every day. Whether it’s creating a budget, building savings, or learning how to invest, these small actions add up over time.

Let’s take a closer look at 6 habits that can hold people back from financial success—and how to replace them with habits that will help you thrive.

As financial expert Dave Ramsey says,

“You must gain control over your money, or the lack of it will forever control you.”

Learning how to manage your money might seem hard at first, but it’s the key to less stress and more opportunities in life. It’s never too late to start getting good financial advice and building good money habits!

Habit #1: Lifestyle Inflation – Spending More as You Earn More

What is Lifestyle Inflation?

Lifestyle inflation happens when you increase your spending as your income grows. Many people see a salary increase as an opportunity to buy more expensive things, often leading to unnecessary expenses and little savings.

When I got my first big paycheck, I splurged on luxury items without considering long-term savings. That moment felt great, but my savings account was empty at the end of the month!

If this sounds like a familiar situation, here’s some popular financial tips….

Solution: Follow the 50-30-20 Budget Rule

To avoid spending more as you earn more, try following this simple yet smart budgeting rule:

Expense Type | Percentage of Income | Example (for $6,000 monthly income) |

Needs | 50% | $3,000 for rent, food, utilities |

Wants | 30% | $1,800 for dining, entertainment |

Savings | 20% | $1,200 for savings and investments |

Adjust these percentages based on your own goals, but don’t forget to set aside a portion of each paycheck, to save.

Habit #2: Not Having an Emergency Fund

Why is an Emergency Fund Important?

An emergency fund is a savings buffer that covers unexpected expenses, such as car repairs or medical bills. Without it, many turn to high-interest loans, creating a cycle of debt that’s difficult to escape.

Experts recommend saving 3-6 months’ worth of living expenses to ensure you’re prepared for emergencies.

Solution: Automate Your Savings

Set up an automatic transfer to a separate savings account each month.

Studies show that automating your savings can increase your success rate by 3.8 times. This works because it takes the decision-making out of the process—basically you save without even thinking about it!

Start with a small, manageable amount, like 20 or 50 bucks, and then slowly increase it over time as your income continues to grow.

Monthly Expense | Emergency Fund Goal (3 Months) | Emergency Fund Goal (6 Months) |

$3,000 | $9,000 | $18,000 |

Automating your savings will also help you build a habit of paying yourself first. This means treating your savings like a bill you can’t skip, ensuring your future financial security.

Over time, this habit can help you create an emergency fund, save for big goals like a home or vacation, or even start investing.

TIP: Open a savings account at a different bank than your checking account.

Opening a savings account at a different bank than your checking account can help you save more by making it harder to access the money. This reduces the urge to spend it. Watching your savings grow over time will motivate you to stick with it and save even more!

Remember, saving doesn’t have to be hard. But automating your savings can make it a lot easier to take that first step toward financial stability.

Habit #3: Overlooking Tax-Saving Opportunities

How to Save on Taxes

Many people don’t take advantage of tax-saving options like employer-sponsored retirement plans or health savings accounts (HSAs).

Learning about these options is an important part of financial education for beginners and can help you save a lot of money.

Take Warren Buffet, for example…..

Obviously, Warren Buffet is one of the richest people in the world, but he pays a lower tax rate than his secretary. How? By using smart financial strategies with tax-saving accounts.

These tools are a great way to keep more of your hard-earned money while planning for the future.

Solution: Contribute to Tax-Advantaged Accounts

Consider contributing to a 401(k) or an Individual Retirement Account (IRA) to lower your taxable income.

Account Type | 2025 Contribution Limit | Tax Benefit |

401(k) | Up to $23,000 | Reduces taxable income |

Health Savings Account | Up to $4,150 | Tax-free for qualified medical expenses |

Traditional IRA | $7,000 (under 50) | Deductible contributions reduce taxes owed |

Habit #4: Ignoring Career Capital and Skill Building

What is Career Capital?

Career capital is all about the skills and knowledge that make you valuable in the workplace. It’s like having a special toolkit that helps you stand out from others. When you build career capital, you develop abilities that allow you to ask for higher pay or better job opportunities.

For example, learning a skill like coding or public speaking can make you more valuable to employers. The more unique and in-demand your skills are, the more opportunities you’ll have to grow in your career.

“The more skills you have, the more valuable you are in the job market, which increases your earning potential.”

Solution: Invest in Skill Building

Dedicate time each week to learn new skills. For example, learning a programming language like Python can make you more efficient and valuable in many jobs.

Skill | Average Salary Increase | Examples of Fields |

Coding | Up to 20% | Data analysis, engineering, IT |

Project Management | Up to 15% | Business, marketing, tech industries |

Financial Literacy | Up to 12% | Finance, management, accounting |

Habit #5: Relying Only on Hard Work, Not Leverage

Why Leverage Matters

While hard work is essential, leverage—using tools, resources, or investments to increase your output—can exponentially increase your results without extra effort.

Imagine throwing a pebble into a lake. Hard work is like throwing pebbles one by one, while leverage is like throwing boulders, creating massive ripples.

Leverage means finding smarter ways to use your time and energy. For example, investing in the stock market allows your money to grow without you having to work for every dollar. Another form of leverage could be using technology or hiring help to manage tasks, freeing you up for more important work. By adding leverage to your efforts, you can reach your goals faster and with less stress.

Solution: Use Financial Leverage Through Investing

Investing allows your money to grow over time. For example, a small annual investment in the stock market can grow significantly with compound interest.

Annual Investment | Average Return (10%) | Value in 40 Years |

$6,000 | 10% | $2.7 million |

Consider using apps like Robinhood or Vanguard for easy investment options.

Habit #6: Accumulating Bad Debt

The Dangers of Bad Debt

Many people rely on credit cards for everyday spending, but this can lead to high-interest debt that’s hard to escape. The average credit card interest rate is about 27.9%, and if you don’t pay off your balance each month, those interest charges can add up fast.

For example, a $300 shopping spree might seem small at first, but with high interest rates, it could snowball into thousands of dollars in debt over time.

Financial education for young people can teach the importance of paying off credit cards in full to avoid these traps. Learning how to manage credit wisely is one of the best ways to build good financial habits and protect your future.

Solution: Use the Avalanche Method to Pay Off Debt

One way to avoid this trap is to use credit cards only for purchases you know you can pay off by the end of the month. If you’re already carrying a balance, consider paying off the debt with the highest interest rate first. This approach, called the avalanche method, can help you save on interest and pay down debt faster.

The Avalanche Method prioritizes paying off debt with the highest interest rate first, saving you money on interest.

Debt Type | Balance | Interest Rate | Minimum Payment | Priority |

Credit Card 1 | $1,000 | 20% | $50 | First |

Credit Card 2 | $2,800 | 10% | $70 | Second |

Car Loan | $17,000 | 8% | $300 | Third |

By focusing on high-interest debt first, you’ll pay less in interest over time and become debt-free faster.

The Wrap on Financial Education for Beginners

Learning and practicing these six habits can completely transform your financial future. Financial education for beginners goes beyond creating a budget or saving a little each month—it’s about making smart decisions, avoiding common money traps, and using strategies to grow your wealth over time.

For those looking for financial advice for low-income earners, starting small is key. Focus on tracking your expenses and setting aside even $5 or $10 at a time. Automating your savings

can make a big difference without requiring constant effort.

Similarly, financial advice for single moms often emphasizes prioritizing needs over wants, finding creative ways to save, and leveraging community resources to build stability.

Whether you begin to familiarize yourself with top financial advice websites or financial education books, for beginners this can and will help you learn how to manage your money better, invest wisely, and plan for your future once and for all.

Start with simple steps, like setting clear financial goals, reviewing your spending, and creating a plan that works for your unique situation.

Remember, small, consistent actions today can lead to a stable financial future. Whether you’re saving for emergencies, paying off debt, or investing in your future, every choice you make now and later matters.

Surprisingly, many schools don’t even bother to teach financial education for beginners, but learning these skills can help young people build a brighter future so please like and share this important information.

Also, don’t forget to leave a comment below with your favorite tip or share your own financial success story! 😊