How to pay off 30000 in debt sounds like one of those goals that belongs on a “future me” vision board… right next to “drink more water” and “stop buying random things from Amazon at 1AM”.

But here’s the truth: paying off $30,000 in debt isn’t magic. It’s not luck. It’s not “being good at math”.

It’s a plan.

And the best plan is the one that works with your life as it is right now, not the life you wish you had.

That being said! In this post, I’m going to show you a simple, step-by-step way to pay off $30,000, even if you have a low income, even if you feel overwhelmed, and even if you’re starting with credit card debt that feels like it’s multiplying while you sleep.

No shame. No perfection. Just a strategy that works.

The First Thing to Know (You’re Not “Bad With Money”)

If you’re feeling overwhelmed, I need you to hear this:

Feeling behind doesn’t mean you’re doomed. It means you’re tired.

A lot of debt payoff stress is emotional. It’s the anxiety, the shame, the “why did I let it get this far?” spiral.

Debt can make you feel like you’re failing at life… even if the debt came from things like:

- medical costs

- dental work

- car repairs

- home repairs

- groceries during a rough season

- literally surviving

So before we talk numbers, let’s do this one mindset reset:

You don’t need a personality transplant. You need a system.

⬆️PIN THIS! ⬆️

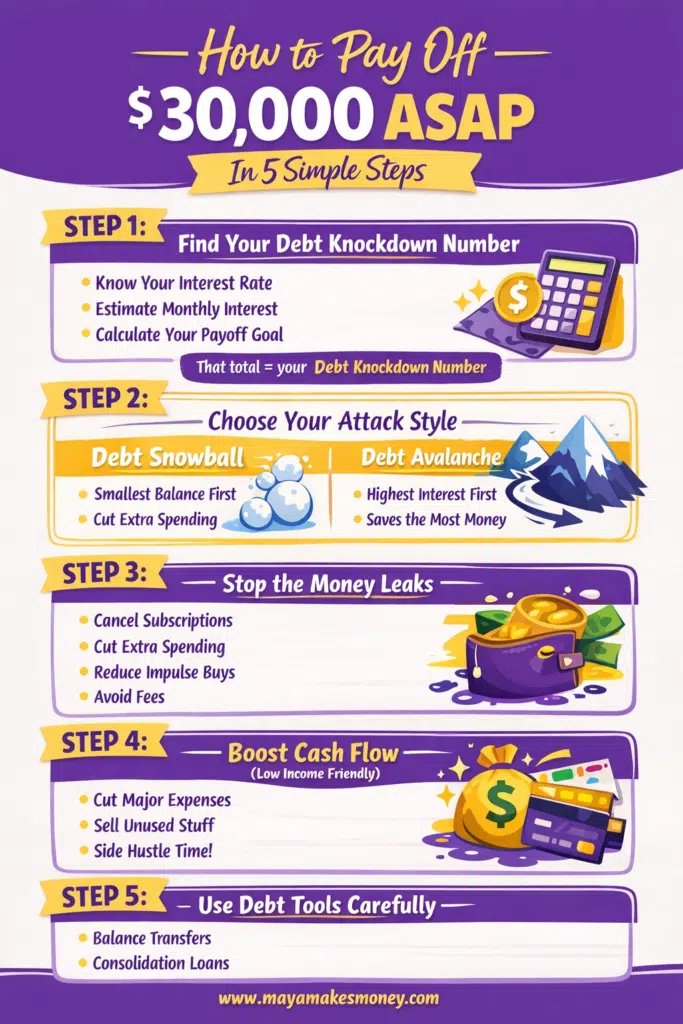

Step 1: Find Your “Debt Knockdown Number” (This Changes Everything)

Most people trying to figure out how to pay off debt quickly only focus on one thing:

“Pay more than the minimum.”

Which is true… but also kind of useless unless you know what “more” means.

Here’s what really matters:

Your payment needs to beat the interest

If your debt is charging you $300 a month in interest and you pay $320, you’re only paying down $20.

That’s why it feels like you’re running on a treadmill while your debt sips iced coffee.

So do this:

- Look at the interest rate (APR)

- Estimate your monthly interest cost

- Decide how much you want the balance to drop each month

- Add them together

That total is your Debt Knockdown Number.

That’s how you create real movement.

Step 2: Choose Your Attack Style (Snowball vs Avalanche)

There are two main ways to pay off debt, and both work.

The “best” one is the one you’ll actually do when life is messy.

Debt Snowball (best for motivation)

This is the classic method:

- Pay off the smallest balance first

- Make minimum payments on everything else

- When the smallest debt is gone, roll that payment into the next smallest

It builds momentum fast, which is amazing if you need quick wins.

This method is great, especially if you’re just learning:

- how to pay off 2,000 in debt

- how to pay off 4,000 debt or even

- how to pay off 5,000 in debt

Because you can knock those out and feel like a powerful goddess who actually has control again. 😉

Debt Avalanche (best for saving money)

This is the “math-first” method:

- Pay off the highest interest debt first

- Minimum payments on the rest

- Roll payments as you go

This is often the fastest way to pay debt off fast when credit cards are involved.

If you’re dealing with:

- how to pay off credit card debt or

- how to pay off large debt

…this one usually saves you the most in interest.

Step 3: Stop Leaks Before You Pour More Money Into Debt

If you’re trying to learn how to save money and pay off debt, this part is non-negotiable.

Because you can’t out-pay off a budget that’s quietly bleeding you.

Here are common “leaks” that don’t feel like much until you add them up:

- subscriptions you forgot about

- convenience spending (coffee, delivery, snacks)

- impulse purchases (especially when you’re stressed)

- overdraft fees

- random “little treats” that turn into $400 a month

Do a 7-day spending audit

For one week, track everything. No judgment.

Then ask:

- What can I reduce without feeling miserable?

- What can I swap for a cheaper version?

- What can I pause for 90 days?

Even freeing up $200–$500/month can massively speed up your payoff!

Step 4: If You Have Low Income, Use the “Cash Flow Boost” Approach

If you’re searching how to pay off debt with low income, you’re not alone.

You don’t need to make $10k a month to pay off debt.

You need more breathing room.

Focus on cash flow, not perfection

Your goal is to increase the gap between:

income – expenses = cash flow

More cash flow means:

- more extra money to throw at debt

- less stress

- fewer “I had no choice but to use the credit card” moments

Ways to boost cash flow without reinventing your whole life:

- reduce one major expense (insurance, phone, subscriptions, groceries)

- temporarily downgrade lifestyle choices (only for a season)

- sell unused items (fastest cash-injection)

- take a short-term side hustle (even 5–10 hours/week)

You don’t need “more money forever.”

You need “more money long enough to finish the job.”

Step 5: Use Smart Tools Carefully (Balance Transfers & Consolidation)

Let’s talk about tools people use when trying to figure out how to pay off debt quickly.

These can work beautifully… or backfire like a cheap lash glue in a rainstorm.

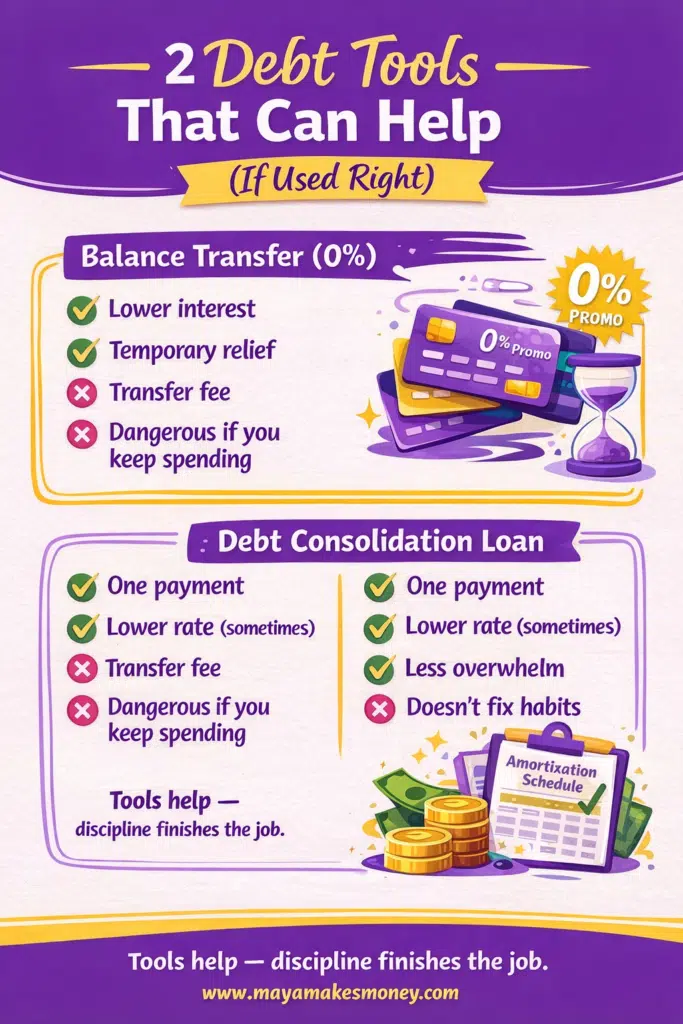

Balance transfer cards (0% promos)

These can help if:

- your credit is decent

- you can stop using the card completely

- you have a payoff plan before the promo ends

Yes, there’s usually a fee (like 3–5%).

But if you’re paying crazy credit card interest, the fee may still be cheaper than months of interest charges.

Important rule:

If you do a balance transfer, that card is now a “debt-only card.”

No purchases. No “just this one time.” No.

Debt consolidation loans

This can help if:

- you have multiple high-interest balances

- you qualify for a lower rate

- you’re overwhelmed managing lots of payments

It won’t fix spending, but it can simplify your life so you can actually focus.

If you want to understand how interest, repayment methods, and consolidation really work behind the scenes, the Consumer Financial Protection Bureau breaks down debt repayment strategies in plain English.

⬆️PIN THIS! ⬆️

A Real-Life Example Plan to Pay Off $30,000 Faster

Let’s make this real.

If you have $30,000 in debt, your timeline depends on how much you can throw at it monthly.

Here are examples:

If you can pay $500/month

This will take a while, but it’s still progress.

The key is making sure $500 is actually reducing the balance (meaning it beats interest).

If you can pay $1,000/month

Now you’re moving. This is where people start to feel momentum.

If you can pay $2,000/month

This is “I’m about to be free” territory.

And remember: most people don’t start at $2,000/month.

They build to it by freeing cash flow, lowering interest, and rolling payments.

Mini Goals That Keep You From Quitting

If you want to learn how to pay off 10000 in debt fast, here’s a secret:

Break the $30k into chunks.

Your brain can handle $2,000 goals much better than a giant $30,000 mountain.

Try this:

- Goal 1: first $2,000

- Goal 2: first $5,000

- Goal 3: first $10,000

- Goal 4: under $20,000

- Goal 5: under $10,000

- Goal 6: DONE

Track it visually

A chart. A whiteboard. A jar drawing. A notes app progress bar. Whatever.

Seeing progress keeps you going when motivation disappears.

The Biggest Mistake People Make When Paying Off Debt Fast

This one is sneaky:

Being so strict you burn out

Yes, being aggressive helps.

But if your plan makes you miserable, you’ll “accidentally” fall off the wagon and then feel guilty… and then avoid your numbers… and then the debt feels even heavier.

So do this instead:

- set a realistic monthly target

- aim for consistency, not perfection

- build in small rewards

- take breaks if needed (without quitting)

You’re paying off debt to improve your life, not punish yourself.

Worth Noting: A Simple “Two-Lane” Plan That Works

If you’re torn between saving and debt payoff, here’s a balanced approach:

Lane 1: Debt payoff

Pay aggressively, especially on high-interest debt.

Lane 2: Tiny savings buffer

Even $500–$1,000 can prevent you from going back into debt when life happens.

That buffer reduces panic spending and financial anxiety big-time.

The Bottom Line

How to pay off 30000 in debt comes down to three things:

- Paying enough to beat the interest

- Choosing a payoff method you’ll stick with

- Increasing cash flow and protecting your mindset

You don’t have to be perfect. You just have to keep going.

One payment at a time, you’re building a life where debt doesn’t get to boss you around anymore.

How to Pay Off 30000 in Debt FAQ

How can I pay off $30,000 in debt quickly?

To pay off $30,000 quickly, focus on high-interest debt first, pay more than the minimum, cut monthly expense leaks, and increase cash flow with temporary income boosts. A balance transfer at 0% can also help if you stop using the card.

What is the fastest method to pay off debt?

The debt avalanche method is usually the fastest because you pay off the highest-interest debt first, which reduces how much interest you get charged over time.

How do I pay off credit card debt faster?

To pay off credit card debt faster, stop using the cards, calculate how much interest you’re paying monthly, and make payments that cover interest plus extra. Consider a 0% balance transfer if you can pay it off before the promo ends.

Can I pay off debt with low income?

Yes. If you have low income, focus on increasing cash flow by cutting expenses, negotiating bills, selling unused items, and using short-term side hustles. Even small extra payments add up when you stay consistent.

Is it better to pay off debt or save money?

If your debt has high interest, prioritize paying it down, but keep a small emergency buffer so you don’t go back into debt when unexpected expenses happen.