This post is all about the 52 week money saving challenge, aka the easiest way to trick yourself into saving money without feeling like you’re being punished for existing.

Listen, I get it. Saving money can feel near impossible when groceries cost $400 and your bank account is giving “low battery” energy.

But this challenge?

It’s simple. It’s kinda fun. And it actually works – even if you’re not a “budget girlie.”

Let’s do this!

☝️ PIN THIS!

What Is the 52 Week Money Saving Challenge?

The 52-week money saving challenge is a savings plan that lasts one full year (52 weeks).

Here’s the whole idea:

- Week 1: Save $1

- Week 2: Save $2

- Week 3: Save $3

- ………etc. etc. etc.

- Week 52: Save $52

That’s it. That’s all there is to it girl!

You’re literally saving the week number in dollars.

And by the end of the year, you’ll have saved $1,378.

Not bad for something that started with ONE DOLLAR, hey? 😉

Why the 52 Week Money Saving Challenge Works So Well

I love this challenge because it builds something most people don’t have yet:

Consistency.

Not motivation.

Not willpower.

Not “discipline queen energy.”

Just simple weekly action.

And that’s how real savings happens.

Even if you’re broke.

Even if you’re busy.

Even if you spend $9 on iced coffee “as a coping mechanism.”

Side Hustle Breakdown (Quick Facts)

Time needed: 2 minutes a week

Total saved: $1,378 in 52 weeks

Difficulty level: Easy at the beginning… spicy near the end 🌶️

Best for: Beginners, busy moms, anyone who needs a system

How Much Money Do You Save With This Challenge?

Like I said above, 2 min a day will save you:

✅ $1,378 saved in one year

That money can go toward:

- an emergency fund

- debt payoff

- a trip

- Christmas gifts

- a car repair fund

- a “don’t talk to me” savings cushion

Whatever you want my dear!

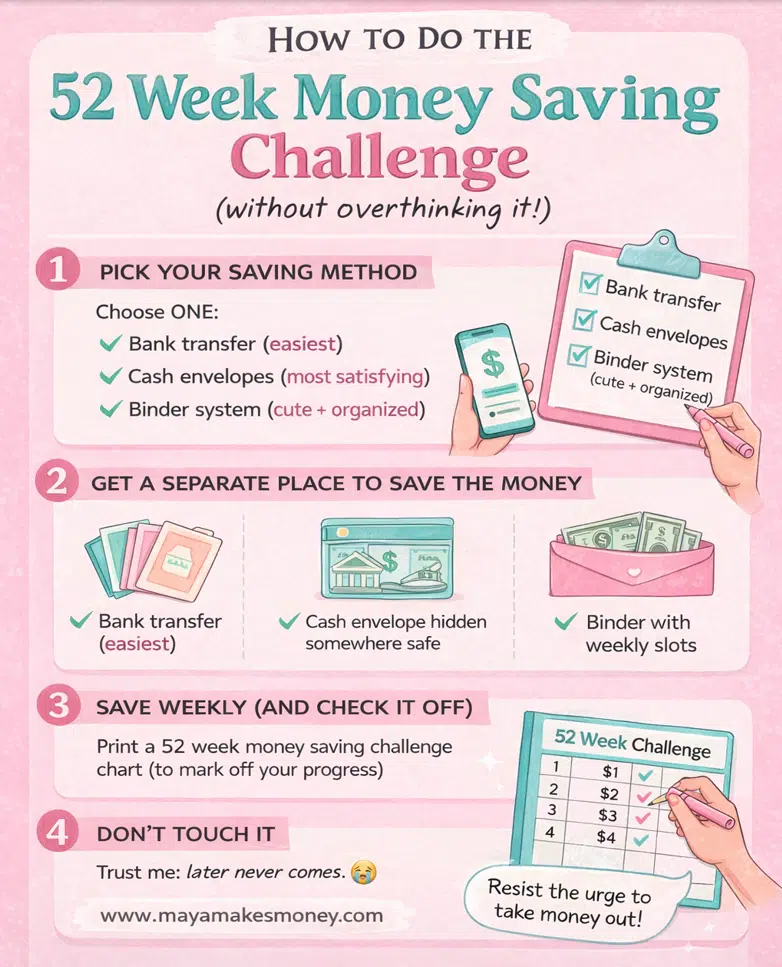

How to Do the 52 Week Money Saving Challenge (Step-by-Step)

Here’s the easiest way to start without overthinking it:

Step 1: Pick your saving method

Choose ONE:

✅ Bank transfer (easiest)

✅ Cash envelopes (most satisfying)

✅ A binder system (cute + organized)

If you love printables, this is where a 52-week money saving challenge binder is perfect.

Step 2: Get a separate place to save the money

This is important.

If your savings is sitting right beside your spending money, your brain will go:

“Wow, free money.”

So, try:

- a separate savings account

- a cash envelope hidden somewhere safe

- a binder with weekly slots

Step 3: Save weekly (and check it off)

You can use a 52-week money saving challenge chart to stay on track.

And if you’re like me and you need visuals or you forget everything…

You’ll want a 52-week money saving challenge chart printable so you can mark off each week like a proud little money goblin.

Step 4: Don’t touch it

This challenge works best when you don’t keep “borrowing” from it.

No “I’ll just take $40 and put it back later.”

Trust me when I tell you, that later never comes. 😭

If you struggle with that, put it in a bank account you don’t have a card for.

☝️ PIN THIS!

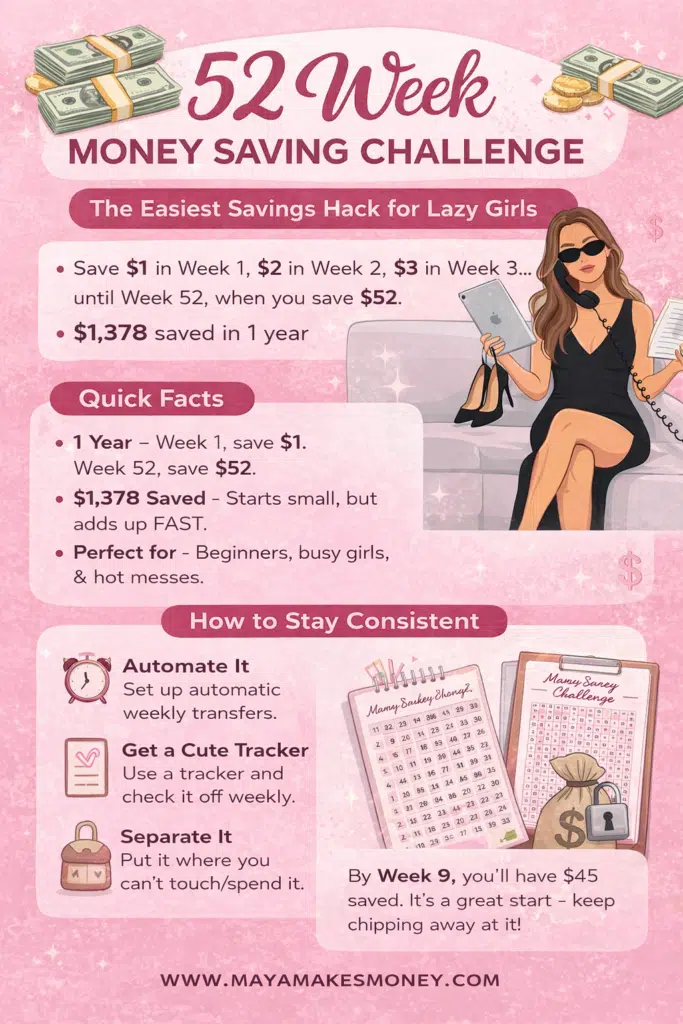

The BEST Way to Stay Consistent (Even When Life Is Chaotic)

Here’s how to actually finish the 52-week money saving challenge without falling off by Week 9.

1. Automate it

If you can, set up automatic weekly transfers.

This is the ultimate “lazy girl” hack.

✅You don’t have to remember.

✅You don’t have to think.

✅You don’t have to fight yourself.

2. Set a weekly reminder

If automation isn’t an option, set a calendar reminder:

“Pay Future Me $___ today.”

That’s it.

3. Start on ANY week

You don’t need to start January 1st.

✅Start today.

✅Start next payday.

✅Start when you feel like it.

The calendar doesn’t control you.

What If You Can’t Afford the Bigger Weeks?

Totally normal.

Weeks 40–52 can feel like a lot.

Here are 5 ways to make it easier:

Option 1: Flip the challenge

Start with $52 first, then go down.

That way it gets easier over time.

Option 2: Save biweekly instead

If you get paid every 2 weeks, save every payday.

Option 3: Double up on smaller weeks

If you miss a week, don’t panic.

Just add it to a smaller week later.

Example:

- Missed Week 31 ($31)

- Add it to Week 34 ($34)

- That week becomes $65 total

Option 4: Use the “$20 per week” version

This is a super popular alternative.

Save $20 every week!

At the end of the year: $1,040 saved

It’s steady and predictable.

Option 5: Do a custom chart

You can create a flexible savings chart where you choose an amount each week.

That’s basically how the bigger challenges work…

The 52 Week Money Saving Challenge Printable

If you want to make this challenge WAY easier, use a printable.

A 52-week money saving challenge printable helps you:

- see the whole year at once

- track your progress

- stay motivated

- feel like a boss every time you check a week off

And yes, people also search for a 52-week money saving challenge free printable because we love saving money while saving money.

(Respect.)

What to include in your printable set

If you’re making your own binder, include:

- a weekly chart

- a savings goal page

- a progress tracker

- a “why I’m saving” page

- mini milestone rewards

That’s how you stay obsessed with finishing.

The 52 Week Money Saving Challenge Printable.

☝️ PIN THIS!

How to Set Up a 52 Week Money Saving Challenge Binder

If you’re a binder girlie, welcome.

Here’s how to set it up:

What you need:

- a small binder (A5 works great)

- clear zipper pouches OR envelopes

- labels for Week 1–52

- your 52-week money saving challenge chart printable

How it works:

Each week, you put the correct amount into that week’s pouch.

It’s like adult sticker books… but with money.

Want to Save More? Try These Bigger Versions

Some people want the basic challenge.

Some people want to go full savage mode.

Here are two popular upgrades:

52 Week Money Saving Challenge 5000

If you want a bigger goal, the 52-week money saving challenge 5000 is a fun one.

Instead of saving the week number, you use a chart with different weekly amounts that add up to $5,000.

It’s flexible and usually includes:

- small weeks ($20–$50)

- medium weeks ($75–$150)

- big weeks ($200+)

This one is great for:

- paying off debt

- saving for a car

- moving out

- a serious emergency fund

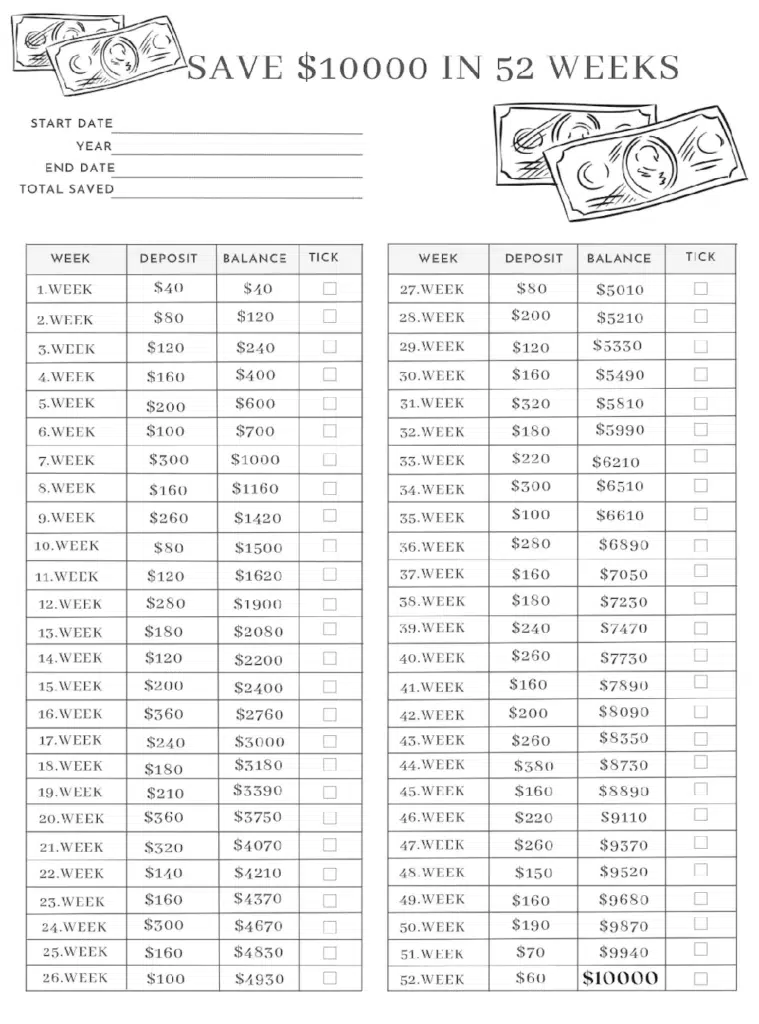

52 Week Money Saving Challenge 10000

Okay boss babe.

The 52-week money saving challenge 10000 is for the girls who want a real glow-up year.

This one works the same way as the $5,000 version, but the weekly amounts add up to $10,000 by the end of the year.

It’s perfect for:

- a down payment

- a “leave me alone” fund

- starting a business

- getting ahead in life FAST

And yes, it looks scary…

But if you’re combining it with:

- tax refunds

- side hustle income

- cashback rewards

- overtime pay

It becomes way more doable.

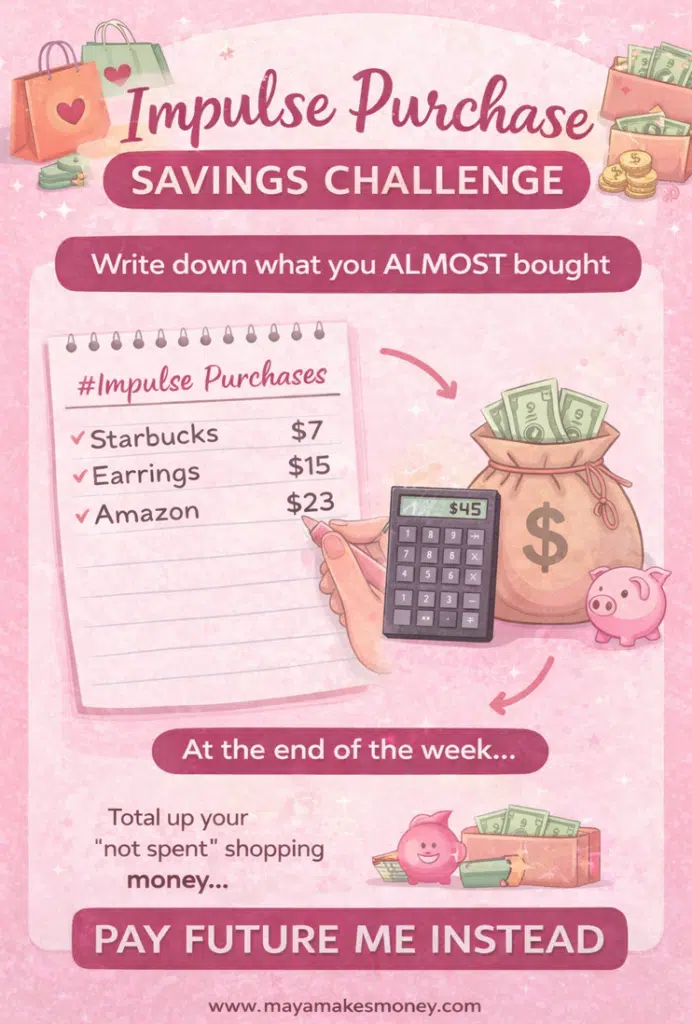

The “Impulse Purchase” Savings Challenge

This is one of my favorite savings hacks from the transcript because it’s so sneaky.

Here’s how it works:

Every time you want to buy something random (Amazon, Winners, Starbucks, whatever)…

Instead of buying it, write it down.

At the end of the week:

Add up what you almost spent…

Then move that amount into savings.

It turns your shopping cravings into savings deposits.

And honestly?

That’s character development. 😅

☝️ PIN THIS!

Common Mistakes People Make (So You Don’t Rage Quit)

Let’s keep it real.

Here’s what usually makes people quit the 52-week money saving challenge:

Mistake #1: Mixing it with spending money

Separate account. Always.

Mistake #2: Starting too many challenges at once

Don’t do 7 savings challenges at the same time.

Start with ONE.

Finish it.

Then get fancy.

Mistake #3: Not tracking it

A 52-week money saving challenge chart makes a huge difference.

Progress feels good.

Progress keeps you going.

Mistake #4: Being all-or-nothing

If you miss a week, you didn’t fail.

You’re just human.

Pick it back up next week.

What Should You Use the Money For?

The best part about the 52-week money saving challenge is that you can use the money for anything.

Ideas:

- emergency fund

- debt payoff

- vacation

- Christmas savings

- school supplies

- car repairs

- home upgrades

- investing starter fund

Or honestly…

Just knowing you have money saved is a flex.

52 Week Money Saving Challenge FAQ

How much money do you save with the 52-week money saving challenge?

If you save $1 in Week 1, $2 in Week 2, and keep going until Week 52, you’ll save $1,378 total by the end of the year.

Is there a 52-week money saving challenge printable?

Yes! A 52-week money saving challenge printable is one of the best ways to stay organized and motivated. You can also find a 52 week money saving challenge free printable online or make your own.

What is a 52 week money saving challenge binder?

A 52-week money saving challenge binder is a binder system where you store cash each week in labeled envelopes or pouches. It makes saving more visual and helps you avoid spending the money.

What is the 52 week money saving challenge chart?

A 52 week money saving challenge chart lists each week (1–52) and the amount you save for that week. A 52-week money saving challenge chart printable lets you check off each deposit as you go.

What is the 52 week money saving challenge 5000?

The 52 week money saving challenge 5000 is a savings plan where you save different amounts each week that add up to $5,000 in one year. It’s a great step up from the basic version.

What is the 52 week money saving challenge 10000?

The 52 week money saving challenge 10000 is a more advanced savings plan where you save varying weekly amounts that total $10,000 by the end of the year. It’s best for bigger goals like a house fund or major debt payoff.

If you want to actually see how your savings will add up (and stay motivated), try using the NerdWallet Savings Calculator to track your progress.

The Bottom Line

The 52-week money saving challenge is one of the easiest ways to start saving money without feeling overwhelmed.

It’s simple.

It’s beginner friendly.

And it turns saving into something you can actually stick with.

Even if you’ve “failed budgeting” before.

Start small.

Stay consistent.

And by the end of the year?

You’re going to have real savings and real confidence.

Which is the whole point.

Worth Noting:

If you want the easiest version, automate it.

If you want the most fun version, use a binder + printable.

And if you want the “main character energy” version…

Go for the 52-week money saving challenge 5000 or even the 52-week money saving challenge 10000.

Your broke girl era ends here. 😉