Tired of working just to keep the lights on and maybe splurge on a latte? Ready to break free from the never-ending cycle of paycheck-to-paycheck living?

You’re in the right place!

Let’s chat about how to make your money work for you, so you can sit back and enjoy the ride to financial freedom (yes, it’s totally possible!).

In this guide, we’re going to cover:

- Your “Freedom Number”: No, it’s not your secret superhero identity. It’s the amount of money you need to be financially free—where work becomes optional. Imagine that!

- 6 Types of Accounts You’ll Need: These aren’t just any accounts, but the super-secret (not really) accounts that will help you grow your money. We’ll also tell you where to open them, based on years of figuring out what works and what doesn’t.

- The “Waterfall” Method: Picture a waterfall—just go with it. This method helps you figure out where your money should go first: pay off debt, save, invest, and more. No more confusion or thinking, “Am I even doing this right?”

We’re breaking it all down, step by step, so by the end of this guide you’ll know exactly how to:

- Start your journey to financial freedom without feeling like you’re drowning in numbers.

- Set up the right accounts to minimize your taxes, grow your money passively (while doing nothing—yes, really), and cover all your financial bases.

- Use the tips and tricks I’ve picked up on my own road to financial freedom before hitting 40!

Ready to dive in? Let’s go!

PART I

What’s Your “Freedom Number”?

Believe it or not, financial freedom isn’t some far-off dream where you have to wait 50 years to enjoy it. Nope, it’s totally possible, and it all starts with knowing how much money you need to officially declare yourself free! This number is your “Freedom Number”—the magic number that tells you exactly how much money you need to quit your job and live your best life.

But wait! Before we get into the nitty-gritty of that, let’s talk about an exciting concept called the Crossover Point.

The Crossover Point: Where the Magic Happens

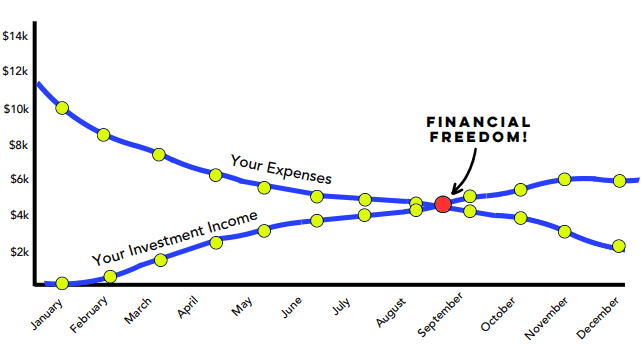

The Crossover Point is a magical moment in your financial journey when the money you make passively (a fancy word for money that rolls in without you having to work for it) from your investments is more than what you spend every month. Imagine it like this: while you’re out living your best life—whether that’s sipping a latte, hiking, or binge-watching your favorite shows—your money is doing all the work for you.

Here’s what the Crossover Point looks like:

- Your expenses (rent, food, shopping sprees, you name it) vs. your investment income (money from your savings and investments).

- The moment your investment income is more than your expenses? That’s when you’ve hit the jackpot—financial freedom!

Calculating Your Freedom Number

To get to your Crossover Point, we need to figure out your Freedom Number – the amount of money you need to live comfortably without working. One of the easiest ways to calculate this is by using the 4% Rule. What’s that, you ask?

The 4% Rule is based on a study from the 1990s (back when Friends was still airing new episodes!).

A smart financial advisor named William Bengen figured out that if you withdraw 4% of your savings each year, your money should last at least 30 years.

Here’s how it works:

Let’s say you need $80,000 a year to live the good life.

Your Freedom Number is $80,000 ÷ 0.04 = $2,000,000.

You need $2,000,000 saved up to generate that $80,000 each year.

Or maybe you can live comfortably on $50,000 a year.

Your Freedom Number is $50,000 ÷ 0.04 = $1,250,000.

You need $1,250,000 to make that happen.

See? It’s just some simple math, but it’s a game-changer. Your Freedom Number gives you a clear, concrete goal to work toward.

How to Find Your Crossover Point

Now that we’ve talked about what your Freedom Number is, let’s connect the dots with your Crossover Point:

- Figure out your yearly expenses: Get a clear picture of what you’re spending each year—everything from rent and groceries to those splurges like avocado toast and Netflix subscriptions. Yes, it all counts!

- Use the 4% Rule: Calculate how much income you can safely take from your investments each year using the 4% Rule.

- Compare the numbers: When the amount you can pull from your investments (using that 4% Rule) is bigger than what you’re spending, congrats! You’ve reached your Crossover Point—and you’re officially financially free!

Example Time!

Let’s say you’ve figured out that you need $60,000 a year to cover your lifestyle. Using the 4% Rule, that means your Freedom Number is $60,000 ÷ 0.04 = $1.5 million.

Once your investments have grown to $1.5 million, you’ll be able to withdraw $60,000 a year without having to work anymore!

Why the Freedom Number Matters

The 4% Rule is a quick and easy way to get your Freedom Number—a target that shows you how much you need to save. And the best part? It’s totally achievable!

Whether your Freedom Number is $500,000 or $5 million, you now know what you’re working toward. It’s no longer just a vague dream, but something real that you can start planning for.

And remember: every journey to financial freedom begins with a single step (or in this case, a single dollar saved!).

Now go forth and calculate your own Freedom Number! 🚀💰

Now that you know how much you need, let’s dive into where you should be saving that money!

PART II

Alright, now it’s time to get into the details! Where should you actually put your money?

With so many options out there, it’s easy to get overwhelmed, but don’t worry—I’ve simplified it for you.

You only need 6 key accounts to make your journey to financial freedom smoother.

And guess what? You’ll want to open them in this exact order for the best results.

The 6 Accounts Needed for Financial Freedom

- High-Yield Savings Account (HYSA)

- 401k

- SEP IRA or Solo 401k

- IRA (Individual Retirement Account)

- Health Savings Account (HSA)

- Taxable Brokerage Account

Each of these accounts has its own superpower when it comes to growing your money, saving on taxes, and keeping your financial bases covered. And don’t worry, we’ll break down exactly what each one does and why they’re so important.

Let’s go over each one on the next few pages to make sure you know exactly why they matter and how to use them to reach your financial freedom goals!

High Yield Savings Account

What is it?

If a regular savings account is like flying in economy, then a High-Yield Savings Account (HYSA) is your free upgrade to first class! Why? Because an HYSA pays you way more interest (we’re talking 10 to 12 times more!) than your average savings account.

Here’s the secret sauce: HYSAs are typically offered by online banks, which don’t have the big fancy buildings or tons of branches to maintain.

So, instead of spending money on overhead, they pass the savings back to you in the form of higher interest rates.

Translation? Your money grows faster without you having to do anything. Cha-ching!

This is why a high-yield savings account is the first thing you want to open. It’s like giving your money a head start in the financial freedom race! 🏃♂️💨💰

What’s it good for?

Think of a High-Yield Savings Account (HYSA) as the perfect place to stash your cash for short-term financial goals—like saving up for a down payment on a house or building that all-important emergency fund.

While your money sits there, it’s earning you passive income (aka money that grows on its own) thanks to that sweet interest rate. Plus, it’s super safe because HYSAs are FDIC-insured—which means even if something wild happens to the bank, your money is protected up to $250,000.

So, whether you’re saving for a rainy day or a big purchase, an HYSA is like a comfy (and profitable!) cushion for your money.

Tips & Tricks

Free money alert! 🚨

Did you know many banks offer cash signup bonuses of up to $500 when you open a new account? Cash incentives, gift cards, electronics (iPad, etc)

Always take advantage of those sweet deals whenever you can—it’s basically free money for doing something you were going to do anyway. Win-win!

Here are some pro tips to maximize your HYSA:

- Set up automatic transfers from your checking account. If saving feels like a struggle, this is your secret weapon! Let the system do the work for you.

- Resist the urge to check your balance every five minutes. Seriously, “out of sight, out of mind” works wonders. Just let your money grow in peace.

- Use this account for specific goals—like “Italy Vacation 2025”! Naming your account something fun helps keep you motivated while you watch those savings stack up.

Where’s the best place to open a HYSA?

SoFi

- High interest rates: SoFi consistently offers some of the best interest rates around, so your money grows faster.

- Vaults feature: You can create up to 20 “sub-accounts” for specific goals—like one for your emergency fund, one for your vacation, and more.

- 55,000+ fee-free ATMs: Easily access your cash without fees, wherever you are.

CapitalOne360

- Competitive APY: The interest rates are solid, though not always the absolute best. But hey, they’re still competitive!

- Backed by a trusted institution: It’s always nice to know your money is in good hands with a reputable financial company.

- Ranked #1 in Customer Satisfaction: J.D. Power ranks it highly, meaning people are generally very happy with their service.

Ally Bank

- Sub-accounts for goals: Similar to SoFi, Ally lets you create “buckets” (sub-accounts) to organize your savings for different goals and name them anything you want.

- No ATM access: Unlike some options, Ally doesn’t offer ATM withdrawals. You can only access your money through online transfers or at physical bank locations.

Discover Bank

- Brick-and-mortar access: Unlike the other options, Discover gives you access to physical branches where you can withdraw or deposit money with a teller.

- No ATM withdrawals: While you can access your money in person, Discover doesn’t offer ATM withdrawals, so you’ll need to visit a branch or manage it online.

All the high-yield savings accounts above are FDIC-insured, so your money’s protected. They also come with easy-to-use web and mobile apps, no minimum balance requirements, and no annoying monthly maintenance fees. So, no hoops to jump through!

Personally, I’ve been with CapitalOne360 for ages. But if I were starting fresh, I’d probably go with SoFi because they consistently offer the highest Annual Percentage Yield (APY) (fancy term for how much interest your money earns).

But listen, switching just to make an extra 0.50% interest might sound tempting, but it’s not worth the hassle for a measly $20 a month. I’ve got my eyes on bigger things—like financial freedom. I don’t waste time on $20 decisions when I’m focused on the million-dollar ones.

So, are you ready to make your money work harder than a squirrel on espresso? 🐿☕️ Open that HYSA and watch your savings grow!

401k (Traditional or Roth)

What is it?

A 401k is like a magical retirement piggy bank that your employer sets up for you. It lets you stash away pre-tax dollars (meaning you don’t pay taxes on that money right now) from your paycheck for the future. The catch? No touching the money until you turn 59½ (unless you want to deal with penalties). And, as of 2025, you can save up to$23,000 a year in your 401k!

But why is the 401k a must-have? Well, here are the two big reasons:

- Employer Match: Many companies will match a percentage of what you put into your 401k. This is literally free money for your retirement! If your employer offers a match, take it. It’s like someone handing you cash for your future just because you saved.

- Tax Advantages: The 401k gives you serious tax perks. But to understand how these savings work, you’ll need to know whether you have a Traditional 401k or a Roth 401k. Each type has different tax benefits, but both can help you keep more of your hard-earned cash.

Let’s break those down next, but one thing is for sure—if you want to build wealth for the long haul, having a 401k is a no-brainer!

When deciding between a Traditional or Roth 401k, the big question is: Do you want to pay taxes now or later?

Here’s the lowdown:

- If you’re in a high tax bracket right now, go for the Traditional 401k. Why? Because you want to take advantage of all the tax deductions while you’re paying a higher tax rate.

Contributions are made with pre-tax dollars, which lowers your taxable income today. - If you’re in a low tax bracket, I recommend the Roth 401k. Since your tax burden is already low, you won’t see much benefit from those tax deductions. The best part about the Roth?

Once your money is in the account, it grows tax-free forever. So even if you wake up one day with a billion dollars (we can dream, right?), you won’t pay a single cent in taxes when you withdraw it!

Here’s a quick breakdown to help:

Traditional 401k | Roth 401k | |

Tax-Free Contributions? | ✅ Yes! Your contributions reduce your taxable income today. | ❌ No. Contributions are made with after-tax dollars, so no immediate tax break. |

Tax-Free Investment Growth? | ✅ Yes! All your investment growth is sheltered from taxes. | ✅ Yes! Your investments grow tax-free too. |

Tax-Free Withdrawals? | ❌ No. You’ll pay income tax on what you withdraw. | ✅ Yes! Withdrawals are tax-free. |

Still confused? Don’t worry. 😊

It all comes down to this:

Would you rather pay taxes now (Roth) or pay them later (Traditional)?

If you’re not sure which one’s better for your situation, here’s a simple tip: Just go with the Roth.

Pay the taxes now, so Future You doesn’t have to worry about it when you’re chilling in your retirement years.

What’s it best for?

The 401k is like a ninja for your savings—it sneaks money straight out of your paycheck before you even see it! That means whatever hits your bank account on payday is what’s left after your 401k contribution has already been set aside for your future. So, you don’t even miss the money because you never got your hands on it in the first place!

If saving money has been a struggle for you, here’s a tip: increase your 401k contribution percentage. You’ll barely notice a difference in your take-home pay, but when you check your 401k balance down the road, you’ll feel like a financial rockstar. 🎸💰

Another awesome perk?

Since you can’t touch your 401k money until you turn 59½, it’s off-limits for those short-term spending temptations. No more dipping into your retirement fund to splurge on the latest gadget or vacation—this money is locked away safely, working hard for your future self.

Always, always, ALWAYS contribute enough to get the full employer match – seriously, never say no to free money! (that’s the definition of insanity right there! Lol)

If your company is offering to throw some extra cash into your retirement fund just because you’re saving, take it! It’s like them saying, “Hey, here’s some money for your future, no strings attached.”

Now, resist the urge to treat your 401k like a piggy bank. Early withdrawals come with hefty penalties, and trust me, that vacation or shiny new gadget isn’t worth it!

This money is for future you – who’s going to want to retire comfortably, not still be working to pay off those impulse buys.

If your company doesn’t offer a 401k, don’t be afraid to ask them to add it as an employee benefit. It’s actually pretty affordable for companies to set up, even if they aren’t offering a match right away.

It’s a win-win for both you and your employer.

Any Tips or Tricks?

Wondering where the best place is to open a 401k? Well, here’s the deal—you don’t really have much choice since your employer picks the 401k provider for you.

But if you’ve got old 401ks sitting around from previous jobs, here’s a pro tip: “roll over” that money into a Rollover IRA.

It gives you more control over your investments and can simplify your accounts. Not sure how to do that? I’ve got you covered—watch this video to learn all about it!

SEP IRA or Solo 401k

What is it?

No workplace-sponsored 401k? No problem! For all you entrepreneurs and self-employed hustlers out there, you’ve got your own options for retirement savings: the SEP IRA and the Solo 401k. These accounts are specifically designed for solopreneurs and small business owners.

Wondering which one is better for you?

Here’s the super simple breakdown:

- If your business is bringing in more than $300,000 in profit, go with the SEP IRA. It’s easier to set up, with less paperwork to worry about.

- If your business is pulling in less than $300,000 in profit, the Solo 401k is your best bet. Why? It lets you contribute more than the SEP IRA, even though it requires a bit more paperwork.

But hey, a little paperwork is worth it if you can save more for your future!

The Basics

SEP IRA

- No withdrawals allowed until you’re 59½.

- As of 2025, you can contribute up to 25% of your net self-employment income or up to $69,000 (whichever is less).

- Super easy to open with minimal paperwork.

Solo 401K

- No withdrawals until you’re 59½.

- As of 2025, you can contribute 25% of your net self-employment income, plus another $23,000, for a maximum total of $69,000.

- Requires a bit more paperwork and effort to open, but worth it for those higher contributions.

So, choose what’s right for your business size and income, and get that retirement fund growing! 💼💰

Hmmm…. are you still wondering which one is better for you? No worries, let me break it down just a tad simpler:

- If your business is making more than $300,000 in profit, it doesn’t really matter—just go with the SEP IRA because it’s easier and less paperwork.

- If your business is making less than $300,000 in profit, the Solo 401k is your best bet. You can contribute more with it, even though the paperwork is a bit more of a hassle. But hey, saving more for your future is worth it!

What’s it best for?

Both accounts are perfect for stashing away a ton of money for retirement while also scoring a sweet tax deduction. And let’s be real—as a business owner, you’re always hunting for every deduction you can get, right?

With a SEP IRA or Solo 401k, you’re not just building your retirement fund, you’re also keeping more of your hard-earned cash out of Uncle Sam’s hands. So why not get closer to your Freedom Number and save on taxes at the same time? Sounds like a win-win!

Any Tips?

Hiring an accountant to handle your tax returns is a smart move—especially when you’re self-employed. They can help figure out how much you should contribute to your retirement accounts each year, because your business income can go up and down. It’s always a year-by-year decision!

And here’s a fun fact: Did you know there’s such a thing as a Solo Roth 401k or a Roth SEP IRA?

Yup, you can totally make Roth-style contributions with these accounts. That means you pay taxes upfront, but all your future withdrawals are tax-free. 🎉

However, not every platform allows Roth contributions with these accounts. So, make sure you pick a provider that does! Below, I’ve listed some places where you can open Solo 401ks andSEP IRAs with Roth contribution options.

Here’s a breakdown of what to look for when choosing a platform for your Solo 401k or SEP IRA, and what some top platforms offer:

- Low-cost mutual funds: Offers a huge selection of low-cost mutual funds, all commission-free, so you can grow your money without extra costs.

- Fractional shares: You can buy fractional shares of stocks and ETFs (which means you don’t need a lot of money to start investing in big companies).

- Recurring purchases: Unlike most platforms, Fidelity allows you to set up recurring purchases of stocks and ETFs, which is super handy for automatic investing.

- All-in-one services: From checking accounts to credit cards, Fidelity is a great one-stop-shop for all your financial needs.

Vanguard

- Low-cost mutual funds: Vanguard has the biggest selection of in-house, low-cost mutual funds (even bigger than Fidelity), and they’re all commission-free.

- Limited services: It doesn’t offer as many banking services as Fidelity, so it may not be the best place if you want to consolidate all your financial accounts in one place.

Charles Schwab

- Smaller mutual fund selection: Schwab’s selection of in-house mutual funds is smaller compared to Fidelity and Vanguard, so sometimes you may need to pay fees for outside mutual funds.

- Top-notch customer service: Schwab has amazing customer service, available 24/7.

- Thinkorswim platform: If you’re into trading options within your stock portfolio, Schwab gives you access to Thinkorswim, an award-winning trading platform.

Which one is the best place to open a Solo 401k?

Here’s a breakdown of key features across different platforms, focusing on their offerings for Solo 401k and Roth Solo 401k options:

Fidelity

- No Roth Solo 401k option: Unfortunately, Fidelity doesn’t offer a Roth Solo 401k.

- Huge in-house mutual funds: It offers a wide variety of low-cost mutual funds, all commission-free, plus the ability to buy fractional shares of stocks and ETFs, making it great for smaller investments.

- Recurring purchases: You can set up automatic recurring purchases for stocks and ETFs, which is a great feature that most platforms only offer for mutual funds.

- All-in-one financial services: Fidelity is excellent for consolidating all your money-related needs, offering checking accounts, debit/credit cards, and other investment options.

Vanguard

- Roth Solo 401k option: Vanguard offers a Roth Solo 401k, so you can make after-tax contributions and enjoy tax-free withdrawals in retirement.

- Massive mutual fund selection: Vanguard has one of the biggest selections of in-house, low-cost mutual funds, but fewer overall financial services than Fidelity (no checking accounts, for example).

Charles Schwab

- Roth Solo 401k option: Schwab offers a Roth Solo 401k, providing flexibility for after-tax contributions.

- Smaller mutual fund selection: While Schwab’s selection is smaller than Vanguard’s or Fidelity’s, it still provides plenty of commission-free options.

- Top-notch customer service: Schwab’s 24/7 customer support is highly rated, and you get access to Thinkorswim, an award-winning platform for trading options.

E*Trade

- Roth Solo 401k option: E*Trade offers a Roth Solo 401k, making it another solid option for after-tax contributions.

- No in-house funds: E*Trade doesn’t offer in-house mutual funds, which means you might pay fees for the best low-cost funds.

- Customer service struggles: Fair warning – E*TRADE’s customer service is sh!t. Sorry guys, but someone had to say it!

To make matters worse, their website interface can be just as frustrating, but it’s one of the few platforms (besides Schwab) offering a Roth Solo 401k.

When choosing the right platform, consider whether you need a Roth option, the variety of mutual funds, and if top-notch customer service matters to you!

When choosing where to open your retirement account, think about what services and features matter most to you—whether it’s the mutual fund selection, fees, or access to banking and customer support.

Here’s my take: Fidelity is my top choice hands down. It’s great in so many ways, but there’s one bummer—it doesn’t offer a Roth Solo 401k option. If you’re really set on getting that Roth Solo 401k, your best bet is to go with Charles Schwab.

And if for some reason Schwab isn’t an option for you, E*Trade is your next best (but definitely third) choice. Just be prepared for a less-than-stellar user experience and customer service.

As for the Roth SEP IRA, no brokerages are offering it yet because the legislation is super new (it was just introduced in the 2023 SECURE Act 2.0).

But don’t worry—I’m sure the big players are working on it, so stay tuned for updates!

IRA (Traditional or Roth)

What is it?

An IRA (which stands for Individual Retirement Account) is a special kind of account designed to help you save for retirement, with some pretty sweet tax perks! The catch? You can’t take out the money until you turn 59½. And as of 2025, you can contribute up to $7,000 a year to your IRA. It’s a great way to stash away cash for your future while enjoying some tax advantages along the way!

What’s it best for?

An IRA is perfect for putting away extra money on top of what you’ve already contributed to your 401k, SEP IRA, or Solo 401k. The best part? Whatever you put into those workplace or business plans doesn’t affect your ability to contribute to a Traditional or Roth IRA.

So, that means even more places to stash away money in a tax-friendly way. Woohoo! 🎉

Now, your biggest decision will be choosing between a Traditional IRA and a Roth IRA. Personally, I’m a fan of the Roth IRA. Why?

Because just like with the Roth 401k, your withdrawals will be tax-free when you finally tap into that money in retirement.

Below is a quick summary of the differences between a Traditional IRA and a Roth IRA to help you decide which one fits your needs!

Traditional vs. Roth IRA: The Breakdown

Here’s a quick look at the differences between a Traditional IRA and a Roth IRA to help you figure out which one is right for you:

Traditional IRA | Roth IRA |

Tax-Free Contributions? | ✅ Yes! Contributions are made with pre-tax dollars, which reduces your taxable income for the year. |

Tax-Free Investment Growth? | ✅ Absolutely! Your investment growth and earnings are tax-free while your money is in the account. |

Tax-Free Withdrawals? | ❌ No, you’ll have to pay taxes on the money when you withdraw it in retirement. |

Cool Features and Important Tips:

- You can contribute to both a Roth and a Traditional IRA in the same year, but your combined total can’t exceed $7,000 (as of 2025).

For example, you could put $3,500 in each type. - Stay-at-home parents can also get in on the action with a Spousal IRA.

This allows you and your spouse to each contribute up to $7,000 per year (so that’s $14,000 combined)! - High earners alert! If your income is over $161,000, you won’t be able to contribute to a Roth IRA.

But don’t worry, there’s a trick called the “backdoor” Roth IRA that lets you get around this. I do it every year, and trust me—it’s super easy!

In short, whether you go with a Traditional IRA or a Roth IRA, both have great benefits to help you save for retirement. And, if you’re feeling ambitious, you can even do both!

If locking up your money until 59½ sounds awful, check out Roth conversion ladders – a trick to access your 401k and IRA funds early without penalties. Don’t overlook these accounts just because of the age limit!

Where’s the best place to open a Traditional or Roth IRA?

Fidelity

- Huge in-house mutual funds: Offers a wide selection of low-cost mutual funds, all commission-free. You can also purchase fractional shares of stocks and ETFs, making it great for small investors.

- Recurring purchases: Allows automatic recurring purchases of stocks and ETFs, a feature most platforms only offer for mutual funds.

- All-in-one financial services: Provides checking accounts, debit/credit cards, and other investment accounts, making it ideal as a one-stop-shop for all your financial needs.

Vanguard

- Massive mutual fund selection: Vanguard has one of the largest selections of low-cost mutual funds that you can buy commission-free, even bigger than Fidelity’s.

- Limited banking services: Doesn’t offer as many account types or banking services as Fidelity, so it’s not ideal for consolidating all your financial needs.

Charles Schwab

- Smaller mutual fund selection: Schwab’s in-house mutual fund selection is smaller compared to Vanguard and Fidelity, meaning you might pay fees for outside funds.

- Amazing customer service: Schwab is known for its 24/7 customer support, and you also get access to Thinkorswim, an award-winning platform perfect for trading options.

E*Trade

- No in-house funds: E*Trade doesn’t offer any in-house mutual funds, so you may end up paying fees to invest in the best, low-cost funds.

- Customer service struggles: E*Trade’s customer service and website interface can be tricky to navigate, but it does offer a Roth Solo 401k, making it one of the few brokerages (besides Schwab) with that option.

Just remember, I believe in you. You’ve got this! You’re a total rockstar, and don’t forget it! 🌟

Health Savings Account (HSA)

What is it?

HSAs (Health Savings Accounts) are like turbo-charged; tax-sheltered accounts designed to help you save for health-related expenses. But here’s the kicker—while their main focus is healthcare, an HSA is one of the best tools to help you reach financial freedom! Unlike other employee benefit accounts like commuter benefits or FSAs (Flexible Spending Accounts), you can actually invest the money in your HSA

Why is this account so special? It’s known as a triple tax-advantaged account, meaning:

- Contributions aren’t taxed.

- Any interest or investment earnings grow tax-free.

- Withdrawals are also tax-free, as long as they’re used for qualified healthcare expenses.

Pretty wild, right? It almost sounds too good to be true—but trust me, it’s really that good! I used to have an HAS with my benefits at my last job. It was like free money; I couldn’t believe how many people weren’t using it. But it was just a few years after I had been there that it was taken away.

The HSA is best for tucking away extra cash after you’ve maxed out your other accounts, like your Roth IRA. For 2025, the annual contribution limit to an HSA is $4,150. It’s also perfect if you expect to have a lot of health-related expenses, now or in the future. If that sounds like you, definitely take advantage of the HSA!

These accounts are usually only available if you’re part of a high-deductible health plan (HDHP), whether through your employer or one you’ve purchased on your own. Not on an HDHP yet? Consider switching during your next open enrollment so you can get an HSA—it’s worth it!

What’s it best for?

- Saving and investing extra money after maxing out your Roth IRA.

- Covering future health expenses with triple tax advantages!

Popular HSA Providers:

If you’re opening an HSA through your employer, they’ll usually choose the HSA custodian (the place where your HSA is managed).

But, if you’re buying your own insurance and opening your own HSA, here are three options I highly recommend:

- Fidelity:

- Offers tons of investment options and access to other financial products like checking and debit cards.

Great for those looking for an all-in-one platform with no account fees.

2. Lively (in partnership with Charles Schwab):

- Gives you access to Charles Schwab’s investment options, though the experience may not be as smooth since it’s a partnership.

- No fees to open, plus you get an HSA debit card for medical expenses.

3. HealthEquity:

- Long-standing HSA provider with a solid reputation.

- Monthly service fee of $2.50 if your balance is under $5,000.

- Limited investment choices compared to Fidelity and Lively, so better for smaller investors.

These options offer different perks based on how you plan to use your HSA—whether you’re more focused on saving or investing!

Taxable Brokerage Account

What is it?

This is called a taxable brokerage account. It’s any investment account that isn’t specifically labeled as an IRA, HSA, 401k, or other retirement-related account.

But unlike retirement accounts, in a taxable brokerage account, you’ll need to pay taxes on any gains or profits from your investments. But the good news? There are no contribution limits, and you can access your money whenever you want!

Why should I get one?

Once you’ve maxed out all your retirement accounts, taxable brokerage accounts are a great option for saving even more money.

The best part? Flexibility! Unlike retirement accounts, you can make contributionsand withdrawals whenever you want, for any amount, with no restrictions. This makes it perfect for growing your investments while keeping easy access to your money if needed.

Tips for Your Taxable Brokerage Account

- Minimize taxes on profits: Try to hold onto your investments for at least 366 days before selling to take advantage of the long-term capital gains tax rate (20%) instead of the short-term rate (which can be as high as 37%).

- Avoid holding bonds: Bonds generate interest income, which is taxed heavily. Instead, keep bonds in tax-sheltered accounts like IRAs or 401ks to avoid those extra taxes.

Best Places to Open a Taxable Brokerage Account

My top recommendations are the same as for Traditional and Roth IRAs:

- Fidelity

- Vanguard

- Charles Schwab

These platforms offer great investment options, low fees, and easy-to-use tools!

Accounts are NOT investments! 💡

Opening and funding your accounts is just the first step. Once the money is sitting in the account, you need to invest it—whether in stocks, mutual funds, or other assets. If you don’t invest the money, it’s just sitting there and won’t grow. So, make sure to take that next step and put your money to work!

PART III

Now that we’ve covered the 6 key accounts you need for financial freedom, you’re probably thinking: “But Maya, how on earth do I prioritize all of this?!” Haha, no worries, I hear you!

I totally get it. Boy, do I get it. It’s tough, and juggling all these financial priorities can feel overwhelming. But here’s the thing—I don’t just get you, I GOT YOU too. Seriously, I’ve got your back, and that’s exactly why I’m here sharing everything I know. My goal is to help you make the best financial decisions possible in every area of your life.

That’s why I created this website – not just to share what I’ve learned, but to grow and learn alongside you. I don’t claim to know everything, but “research” is my middle name.

The internet is amazing because there’s a whole world of info at your fingertips. Google is your friend – you just have to ask her the right questions! 😉

With everyday bills, credit card payments, student loans, saving for financial freedom, and let’s not forget that awesome vacation next summer, it can be hard to figure out where to focus your money.

The best way to approach this?

Think of it like a waterfall: each financial goal gets tackled in order, with the most important things at the top, making sure you handle one priority before moving on to the next.

Let’s break it down, shall we?

Managing money can feel like juggling a lot of things at once. But don’t worry! Think of it like a waterfall—each step flows into the next.

Here’s how to prioritize your money:

- Bills & Necessities

First, make sure your rent, utilities, and groceries are covered. You can’t save money if your basic needs aren’t met! - Emergency Fund

Next, build an emergency fund. Aim to save 3-6 months of living expenses. If you have credit card debt, start with $2,000 in savings and use the rest to pay off debt faster. - Pay Off Credit Card Debt

Focus on paying off your credit cards as fast as you can. Credit card debt is expensive, and getting rid of it is a big step toward financial freedom. - Max Out 401k Match (if you have it)

If your job offers a 401k match, contribute enough to get the free money! Don’t leave any free cash on the table. - Max Out Roth IRA or Backdoor Roth IRA

Everyone should aim to max out a Roth IRA. This account helps your money grow tax-free, which is a huge benefit for your future. - Max Out HSA (if eligible)

If your health insurance allows for a Health Savings Account (HSA), max it out. It’s a triple-tax advantage: tax-free contributions, growth, and withdrawals (for medical expenses). - Pay Off Student Loans & Car Loans

Once your investments are started, focus on paying off your student loans and car loans. Financial freedom also means being debt-free. - Max Out 401k (or Solo 401k/SEP IRA)

Beyond the employer match, max out your 401k. You can contribute up to $23,000 (or $69,000 with a Solo/SEP IRA), which helps shield your income from taxes. - Other Financial Goals

Do you have other goals like paying off your mortgage or saving for a house? Now’s the time to work on those! This helps you stay on track to financial independence. - Taxable Brokerage Account

If you’ve maxed out everything above, you’re doing awesome! Now you can start investing extra money in a taxable brokerage account to grow your wealth for early retirement.

By following the Waterfall Method, you can ensure that you’re managing your money wisely and setting yourself up for financial success, step by step! 💦💰

Every time you get paid, think of your money as water filling up a series of cups. Start with the first cup, filling it completely, and then move on to the next one. If a cup is already full, let the money “overflow” into the next cup, and so on.

For example, some cups, like your Roth IRA, reset every year because there’s a limit to how much you can contribute annually. Others, like your emergency fund, stay full once you’ve saved enough, so you don’t need to keep adding to it.

The trick here is to tackle your financial goals one at a time. If you try to fill all the cups at once, you won’t make much progress—it’ll feel like you’re barely moving forward.

Think of it like aiming a firehose at one goal instead of sprinkling your money everywhere. This approach is way more effective and motivating!

The average person might struggle to save, let alone aim for financial freedom—but why settle for average? If you’re serious about achieving financial freedom, you’re going to have to stretch yourself and make more money.

That’s the only way to create the “overflow” needed to fill all those cups in the Waterfall Method and move closer to your goals.

Instead of asking, “Why do I make so little?” start asking, “How can I make more than I do now?” Here are some ideas to get you started:

- Learn high-income skills: Pick up in-demand skills like coding, data analytics, AI, content creation, video editing, online marketing, ordirect response copywriting. These skills command top dollar!

- Negotiate your pay: Every 6-12 months, ask for a raise or hop to a new job with better pay. Don’t settle—always look for opportunities to grow.

- Build your network: Expanding your connections opens doors to bigger career opportunities.

- Work on your mindset: Improving your mindset can change how you approach money and success. Be open to receiving more.

- Find mentors and coaches: Learn from people who’ve already achieved massive success. Success leaves clues—observe and copy what works.

Remember, the financially free version of you won’t look anything like you do today.

Be open to greatness, embrace new ideas, and when the money starts rolling in, simply follow the steps in this Financial Freedom guide and you’ll be golden! 💪🚀

Your Path to Financial Freedom

Financial freedom isn’t about never working again—it’s about making work optional. It’s about escaping the grind of working just to pay the bills.

Imagine waking up each day and deciding what you want to do with your time, all while your investment income covers the expenses.

That’s the true beauty of financial freedom.

You’ve now learned about the Waterfall Method and the 6 essential accounts that will help you on your journey. You know how to prioritize your money, pay off debt, invest for your future, and create overflow.

But more importantly, you’ve been equipped with the mindset and strategies needed to stretch yourself and make more money, pushing you closer to your goals.

Remember, financial freedom doesn’t happen overnight. It requires patience, persistence, and a willingness to grow. Don’t settle for average—you’re capable of so much more.

With the steps we’ve outlined and the tools at your disposal, you’re on your way to building a life where you call the shots, where money isn’t a daily worry, and where you’re free to pursue your passions.

Keep pushing, keep growing, and always believe in your ability to achieve financial freedom. The journey might be challenging, but the reward—freedom to live life on your terms—is worth every step.

So, follow the plan, take action, and watch as your money starts working for you.

You got this! 💪💸